- Reporting by Agência Pública has revealed how investors including U.S. pension funds and an Argentine agribusiness giant may be linked to illegal land deals and deforestation in Brazil’s Cerrado region.

- The investors hold large stakes in BrasilAgro, a company that specializes in buying up land and selling it to agribusiness operators.

- Under Brazilian legislation that restricts land sales to foreign entities, the acquisitions by the largely foreign-controlled BrasilAgro have come under suspicion, with an investigation launched in 2016.

- While the probe is still ongoing, it has identified what experts say is a common practice of using shell companies and other legal subterfuges to skirt the restrictions.

- Translated by Matty Rose, as part of LAB’s ongoing partnership with Agência Pública. This English version was first published by Agencia Publica on 29 May 2021 and by Mongabay on 29 July. It is based on AP’s ‘Amazonia sem Lei’ project and further details are given in the AP podcast (in Portuguese), ‘De Los Angeles ao Cerrado‘

- Agência Pública also has an international newsletter in English, which you can subscribe to here.

Major international investors have in recent years publicly flagged the environmental risks of doing business in Brazil, particularly since Jair Bolsonaro took office as president at the start of 2019.

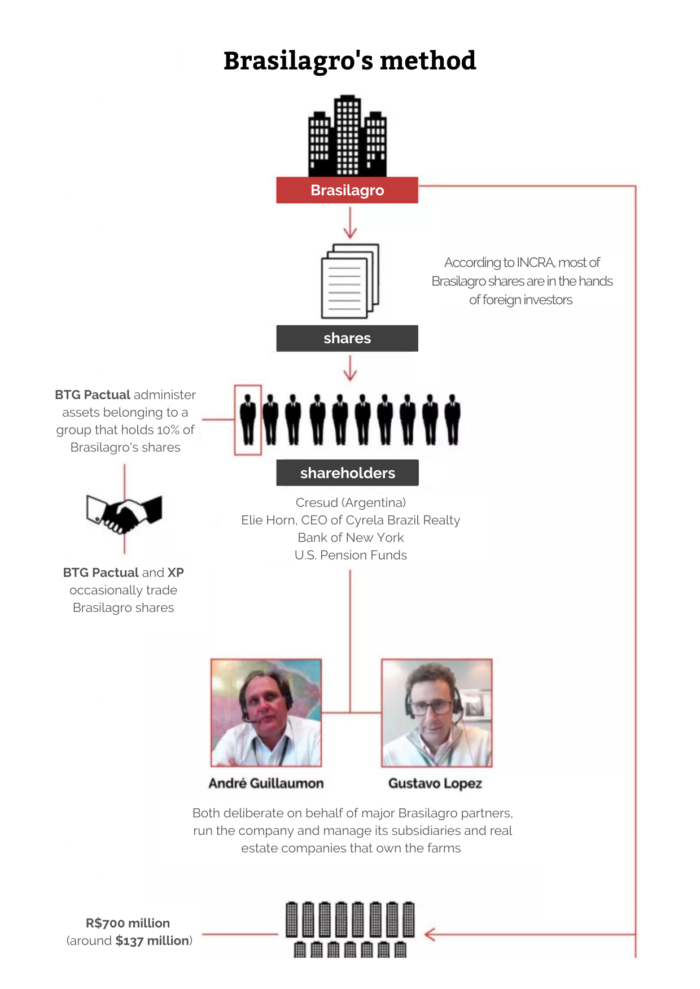

But behind the scenes, activity in the financial markets reveals a different side to this story. On Jan. 24 this year, Brazilian investment manager XP Investimentos joined forces with domestic competitor BTG Pactual for a multimillion-dollar deal with BrasilAgro, a company that buys up large swaths of land and sells it to agribusiness operators. Together, the two banks and their subsidiaries in the U.S. would go on to sell more than 670 million reais ($129 million) in shares in one of “the largest Brazilian companies in terms of quantity of arable land” in the country. A key part of the deal: both BTG and XP would buy up whatever land wasn’t bought by third parties.

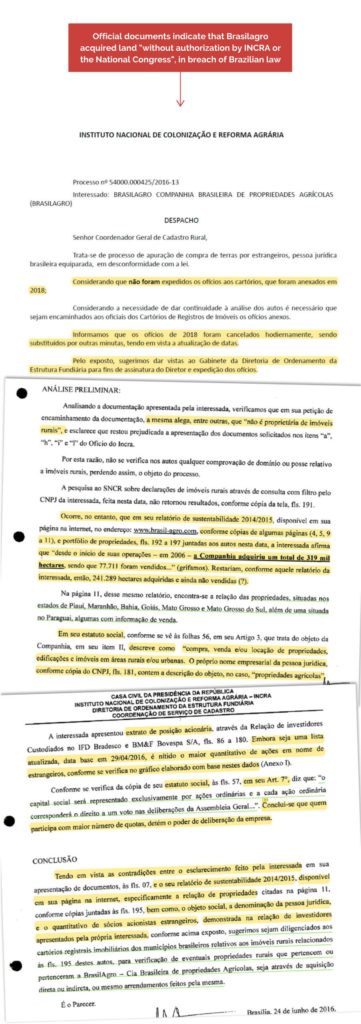

The issue, however, is that the Brazilian government has been investigating BrasilAgro since 2016 for suspected illegal land acquisitions. According to INCRA, the federal agency that deals with land ownership in Brazil, the company is suspected of acting “in breach of the law,” working its way around limits imposed on the sale of land to foreign buyers.

Despite the company’s name, BrasilAgro is largely controlled by investors in Argentina and the U.S., according to documents obtained by Agência Pública. A range of official documents points to purchases by this international group in the states of Bahia, Maranhão and Piauí — all “without authorization by INCRA or the National Congress,” in breach of Brazilian law. There are prevailing restrictions on the sale of land to foreigners in Brazil, including limits on the areas that can be bought and a requirement of prior authorization by the Brazilian government.

BrasilAgro’s farms stretch across the cradle of Brazil’s waterways, the Cerrado, a biome crossed by three of the biggest watersheds in South America. Part of the company’s landholdings lie in the new frontier of soy plantations, known as the Matopiba, which encompasses the border region of the states of Maranhão, Tocantins, Piauí and Bahia (the name “Matopiba” is a portmanteau of the states’ names). In this area that’s bigger than France and England combined, reports of land grabbing and deforestation have increased along with land prices since the 2000s.

Data gathered by Chain Reaction Research, a consortium that monitors agribusiness on a global scale, show that, between 2012 and 2017, BrasilAgro cleared more than 21,000 hectares (52,000 acres) of native forests on its estates.

In its annual report for 2019, the company noted that part of the deforestation was the subject of a trial and awaiting judgment. In 2013, IBAMA, the Brazilian environmental regulator, fined BrasilAgro 5.9 million reais ($2.5 million) for the illegal deforestation of a permanently protected area in the state of Goiás.

The company went to court over the matter and, in 2019, noted in a filing to the U.S. Securities and Exchange Commission, “We are currently awaiting a ruling on IBAMA’s appeals. Considering there has been a favorable decision at the lower court level in this particular lawsuit, our chances of loss have been classified as remote.”

Part of BrasilAgro’s business model is to buy and “prepare” land for the cultivation of sugarcane, corn and soy, or large-scale cattle ranching. Buyers of these commodities include major multinationals such as U.S.-based Bunge and Cargill, and the Anglo-Swiss trader Glencore. In the process, what was once the biodiverse Cerrado biome has now become a financial asset: land that has been deforested and registered with the government is more valuable as far as agribusiness is concerned.

“The creation of specific investment funds, such as FIAGRO, a market for land where landowners can ‘divvy up’ their properties and create multiple registrations with INCRA, and real estate speculation are indicators of a ‘financialization’ of land and agribusiness in Brazil,” says Fábio Pitta, a professor at the University of São Paulo (USP) who has spent years researching the role of foreign investors in the destruction of the Cerrado and its people, especially in the Matopiba region.

“Rural producers rely on future commodity prices, which are dictated by the financial market. They produce in order to pay their debts, but in doing so they accumulate new debts. In other words, it is a [business] model that follows the pattern of a speculative bubble,” says Pitta, who is also a member of the Social Network for Justice and Human Rights.

‘Room for everyone to grow in this business’

In July 2020, a few months before the share sale, BrasilAgro CEO André Guillaumon pitched his group’s credentials in a chat with XP Investimentos. “We have a portfolio of nearly 300,000 hectares [741,300 acres] in Brazil,” he said, adding, “there’s room for everyone to grow in this business.”

In September last year, it was BTG Pactual’s turn to enter the fray. The investment bank had taken over a new fund linked to BrasilAgro, valued at more than 363 million reais ($70 million) by May 10 this year, according to the Brazilian Financial and Capital Markets Association (ANBIMA).

BTG Pactual effectively controls part of the assets and liabilities of the agribusiness giant through this fund. In this way, the bank trades the shares belonging to São Paulo-based group Charles River, which specializes in riskier equity market investments on the stock market. The group holds nearly 10% of BrasilAgro’s shares.

Among the other shareholders in the agricultural giant that have voting rights are funds linked to U.S. banks Citibank and JP Morgan, both accused of complicity in the destruction of the Amazon rainforest and its peoples, as well as Swiss bank Credit Suisse and Brazil’s Itaubank S.A., part of the Itaú financial services group. Both BTG Pactual and XP Investimentos declined to comment when contacted by Agência Pública.

Foreign interests take aim at Brazil’s national territory

Since 2010, INCRA has been responsible for authorizing the sale of land to foreign interests, particularly for medium to large estates, which is BrasilAgro’s niche. The company has already made the case to the government that “it does not own rural real estate.” But government inspectors have revealed that as of 2016 the company had “acquired a total of 319,000 hectares,” or about 788,000 acres.

To prove that this arrangement was not illegal, BrasilAgro had to show the land titles in its name and demonstrate show that it wasn’t a company with a foreign directorship. As there had already been suspicions raised about the company, INCRA opened proceedings to clear up the matter in May 2016, obliging BrasilAgro to send, in the month following the start of the investigation, a long list of documents: 200 pages of statements, fiscal documents, and a complete list of its shareholders at the time.

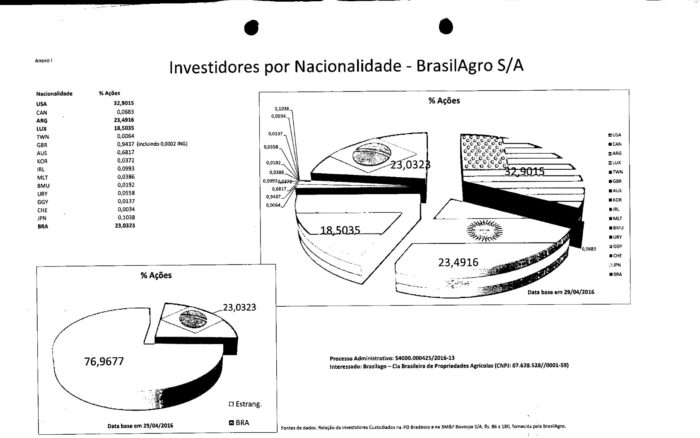

What the federal land agency discovered was that every share traded on the stock market in Brazil or abroad corresponded to a vote in BrasilAgro’s general assemblies. “One can conclude that whoever holds the highest number of shares is the one that has the real decision-making power in the company,” it said in an official document.

And the largest group of shareholders, government inspectors found, “are those registered under foreign names.”

The rapid progress of the investigation in 2016, the year Brazil was consumed by the impeachment drama of then-president Dilma Rousseff, stalled during the subsequent administrations of Michel Temer and Jair Bolsonaro. In practice, the directors of INCRA, at the time appointed by the Centrão — the group of politicians from various political parties who lack a defined ideological orientation and instead seek a close relationship with the executive branch of government in order to increase their influence and defend their interests — did not proceed with the investigators’ requests, delaying any future discoveries about the company.

The investigators requested information from notary offices across the Cerrado region. To confirm or dispel their suspicions, INCRA would have to search the notary offices to find the records for the farmland declared by BrasilAgro.

During the same period, the issue regained political prominence. At the end of 2020, the Brazilian Senate approved legislation that would ease the process of selling land to foreign interests, with the bill now before the Chamber of Deputies, Brazil’s lower house of congress.

Musical chairs

Less than a month into the investigation, INCRA had identified 241,289 hectares (596,238 acres) of farmland “bought and not yet sold” by BrasilAgro. The agency told Agência Pública that these purchases had not been approved.

Shortly before, in January 2016, the then-president of the company was looking ahead to making further purchases in the country. “When we look at the exchange rate and our margins, and we see very important [land] acquisition opportunities, these kinds of deals are becoming more interesting,” Júlio César de Toledo Piza Neto told the newspaper Estadão.

After eight years at the company, Piza Neto left his roles as the company’s president and director of investor relations. Piza Neto was one of BrasilAgro’s biggest names on the financial markets; today he’s a member of the Agribusiness Superior Council at the Federation of Industries of the State of São Paulo (Fiesp), with his term set to run until the end of 2021.

Piza Neto wasn’t the first big name previously associated with BrasilAgro — at least not publicly. Before him, billionaire property developer Elie Horn nurtured a “strong relationship for over 15 years” with BrasilAgro’s majority shareholders.

The founder of Cyrela, one of the biggest construction firms in Brazil, Horn worked to boost BrasilAgro’s credibility on the financial markets, according to Bloomberg. Although he left BrasilAgro’s board in June 2012, Horn remains a shareholder: he holds shares in the company giant under his own name and that of his company, Cape Town LLC, registered in the U.S. state of Delaware.

In an interview with Agência Estado, Horn predicted a “new property boom” following Bolsonaro’s victory in the 2018 election. “I would just like for the boom to not be as big as it was in the past,” he said at the time. He also declared himself “thrilled” with the incoming government.

A laborious process

After the first few indications of irregularities at BrasilAgro, INCRA needed to find the registration records for the company’s rural estates in the notary offices. That would allow inspectors to ascertain where it was that BrasilAgro was suspected of having rented, taken over or bought land illegally. At this point, the investigation started to slow.

It took nearly two years between a recommendation to take further action and a request to send off official documents to the notary offices. In March 2018, just one signature by the director of land ownership planning was needed in order to expedite the documents. Instead, there was another delay, for one year, until they were finally sent in May 2019; three different directors had passed through the role by then.

One of the officials involved in the investigation into BrasilAgro told Agência Pública that they “didn’t remember” if the internal changes at INCRA affected the investigation. “Investigations often take a long time because we have very few staff at our disposal. We can only look into what our team can handle in terms of the workload,” the official said, speaking on condition of anonymity.

Officially, INCRA says the investigation continues “under the auspices of the Division for Inspection and Monitoring of Foreign Acquisitions.” The latest development was “the expedition of eight official letters” to notary offices in the states of Piauí, Maranhão, Mato Grosso, Bahia, Minas Gerais and Goiás.

The government maintains the understanding that “rural properties were purchased by BrasilAgro without the authorization of INCRA or the National Congress, following the publication of Parecer AGU/LA-01/2010,” the legislation that regulates the issue.

The alleged method

Agência Pública contacted the notary offices that had received requests for information by INCRA as part of their search for the records of BrasilAgro’s farms. Only one responded: an office in Correntina, in the far west of the state of Bahia. The official responsible there claimed to have not received any documents from INCRA. But in the material consulted by Agência Pública, there is proof of shipment by INCRA.

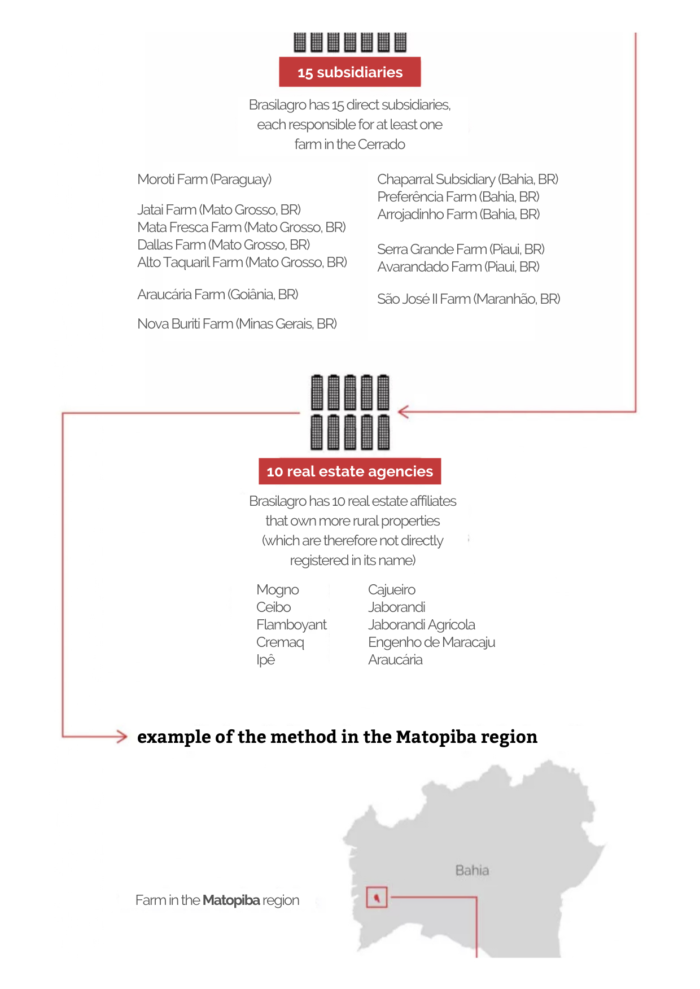

Following this loose end, Agência Pública identified a possible method behind BrasilAgro’s activities. The Chaparral estate in Correntina is one of the five farms that the company owns in the western Bahia. More than 2,000 times the size of Rio de Janeiro’s cavernous Maracanã Stadium, the estate lies along one of the main trucking routes for agricultural produce in this part of the country, the BR-020 highway, and produces cotton, corn and soy.

Cases of deforestation in the region have already been flagged by the consortium Chain Reaction Research, such as in December 2018, when BrasilAgro was suspected of clearing almost 2,000 hectares (5,000 acres) of native forests in the region.

Even though Chaparral is under the control of BrasilAgro, it’s not registered in its name. According to the federal government’s Land Management System, the farm belongs to Imobiliária Cajueiro Ltda., whose legal guarantors are the president and the director of BrasilAgro: André Guillaumon, from São Paulo, and Gustavo Javier López, an Argentinian national.

Both companies are located at the same São Paulo address, on Avenida Brigadeiro Faria Lima. “It is a very common practice in the country because, in the event that any problems arise, the businessmen are able to ‘cut ties,’ thereby stopping any penalties hitting their assets. For foreigners, however, this practice is illegal,” according to an official at INCRA involved in the BrasilAgro case.

“In six months, it was possible to reach a conclusion on the case, by asking the notary offices for information, making inquiries, and contacting bodies responsible for shareholding control in the country,” the official said, also speaking on condition of anonymity.

BrasilAgro used the same approach with its eight other properties in the Cerrado, valued at approximately 380 million reais ($74 million), according to the Special Department of Federal Revenue of Brazil. As the second INCRA official explained, “There are companies that divide their territories into two, three, or multiple CNPJs [National Registry of Legal Entities number], sometimes with the intention of evading inspectors, although it’s also an accounting control and legal maneuver commonly employed in Brazil.” By doing this, the official said, BrasilAgro could dissociate its farms from its own national registry number.

“When you create a string of CNPJs like this, you make it very difficult for the people working at the notary office, since they will be evaluating the documents of a company registered in Brazil, with its headquarters in Brazil, with Brazilians among the shareholders, which nevertheless will be companies controlled by corporate groups abroad. It’s a way of getting around the law,” says Maurício Correia, a lawyer who coordinates the Association of Lawyers for Rural Workers of the State of Bahia (AATR). The association has been monitoring the purchase of land by foreigners in the Cerrado for years.

According to Correia, the same practice of real estate control by foreign-owned groups has already been identified in the far west of Bahia. He says the government could decree BrasilAgro’s purchases to be null and void if the irregularities are proved. “In practice, the investors would lose their land without there necessarily having to be an official deregistration in the municipal notary offices,” Correia says.

One billion reais’ worth of land

Data from the Special Department of Federal Revenue of Brazil gathered by the website Brasil.io show that BrasilAgro is worth more than 1 billion reais (nearly $200 million), when taking into account its real estate and direct affiliates.

The company opened seven of these affiliates after the 2010 legal landmark that restricted the sale of Brazil’s land to foreign interests. It is these affiliates under which the Arrojadinho farm, also in western Bahia, and the São José II farm, in São Raimundo das Mangabeiras (Maranhão state), among others, are registered.

São José II is a little more than 17,000 hectares (42,000 acres), of which 10,000 hectares (24,700 acres) are dedicated to the cultivation of corn and soy in the Maranhão area of the Cerrado. BrasilAgro itself announced this 100 million reais ($19 million) purchase to its shareholders in 2017.

The same method has been used again in the state of Piauí during the pandemic. In May 2020, the company bought a farm measuring 4,500 hectares (11,100 acres) in Baixa Grande do Ribeiro, one of the front lines in the advance of soy plantations in the Matopiba region. It paid 25 million reais ($4.8 million) for the land, once again without the oversight of INCRA or the National Congress.

BrasilAgro told Agência Pública that it is “a Brazilian company with stocks listed on the Novo Mercado segment on the B3 stock exchange and we conduct our business using the very best practices in corporate governance.”

“We would like to reiterate that all deals and transactions carried out by the company are in line with the relevant legislation,” the company said via a note for our report.

XP Investimentos told Agência Pública that allegations of improper land deals “have no basis in truth.”

Brazilian in name only?

Argentine ranchers, as well as the Bank of New York, various pension funds in the U.S., and many offshore companies registered in tax havens, are among the beneficiaries of BrasilAgro’s operations.

Cresud, the Argentine agribusiness giant, holds the majority of individual shares in the company. It has made no attempt to cover up the risks that its activities in Brazil entail to investors in the U.S.

“The implementation of the law [that restricts the sale of land in Brazil to foreign buyers] could mean we require approval before future purchases … and other additional procedures, which could result in delays and/or the inability to obtain the approval required by the law,” Cresud said in a June 2020 filing to the U.S. Securities and Exchange Commission.

On BrasilAgro’s website, there is barely a mention of other shareholders. But Agência Pública was able to identify major investors from the U.S., such as a number of retirement funds — ranging from the Utah Retirement Systems, to the Los Angeles City Employees Retirement System and the Public School and Education Employee Retirement Systems of Missouri — all of which have voting rights in BrasilAgro’s stockholder meetings.

One of the representatives of these investors in Brazil is Ricardo José Martins Gimenez, a businessman and decision-maker at BrasilAgro on behalf of the Bank of New York and the pensions fund division of the New York City Comptroller.

Martins Gimenez also represents an offshore company called Kopernik, based in the Cayman Islands and the state of Delaware, according to U.S. regulators. Kopernik also has voting rights in BrasilAgro’s stockholder meetings.

None of the U.S. pension funds or the Argentinian investors from Cresud had responded to Agência Pública’s requests for comment by the time this report was published.

A North American offensive

The BrasilAgro case highlights, once again, the presence of U.S. investors in the Brazilian Cerrado. There are two other noteworthy groups involved: the retirement fund for North American teachers, known as TIAA, and Harvard University.

Reports by the Social Network for Justice and Human Rights suggest that both groups have accumulated more than 750,000 hectares (1.85 million acres) of land in Brazil since 2008. Adding the land owned by BrasilAgro, U.S. investors hold sway over more than 1 million hectares (2.5 million acres) in the Cerrado.

It’s estimated that Harvard alone has already spent nearly half a billion dollars on land in this region that serves as the cradle of many of Brazil’s great waterways.

As reported by Agência Pública, the money from the Ivy League university financed land grabbing in the state of Bahia for a farm bigger than the city of São Paulo. The case led to a lawsuit in state-level courts, with developments in the case in October 2020, as reported by Mongabay.

Banner image: Soy farming in Brazil. Image by Lou Gold via Flickr (CC BY-NC-SA 2.0).