Nov 21 2014: With Republicans winning big in the midterm elections, the debate over so-called “free-trade” agreements could again take center stage in Washington.

President Barack Obama has been angling for “fast-track” authority that would enable him to push the proposed Trans-Pacific Partnership, or TPP—a massive free-trade agreement between the United States and a host of Pacific Rim countries—through Congress with limited debate and no opportunity for amendments.

From the outset, the politicians who support the agreement have overplayed its benefits and underplayed its costs. They seldom note, for example, that the pact would allow corporations to sue governments whose regulations threaten their profits in cases brought before secretive and unaccountable foreign tribunals.

So let’s look closely at the real impact trade agreements have on people and the environment.

A prime example is the Dominican Republic-Central America Free Trade Agreement, or DR-CAFTA. Brokered by the George W. Bush administration and a handful of hemispheric allies, the pact has had a devastating effect on poverty, dislocation, and environmental contamination in the region.

And perhaps even worse, it’s diminished the ability of Central American countries to protect their citizens from corporate abuse.

So let’s look closely at the real impact trade agreements have on people and the environment.

A prime example is the Dominican Republic-Central America Free Trade Agreement, or DR-CAFTA. Brokered by the George W. Bush administration and a handful of hemispheric allies, the pact has had a devastating effect on poverty, dislocation, and environmental contamination in the region.

And perhaps even worse, it’s diminished the ability of Central American countries to protect their citizens from corporate abuse.

In contrast to their Central American neighbors, El Salvador and Costa Rica have imposed regulations to defend their environments from destructive mining practices. Community pressure to protect the scarce watersheds of El Salvador—which are deeply vulnerable to toxic mining runoff—has so far prevented companies from successfully extracting minerals like gold on a large scale, and the Salvadoran government has put a moratorium on mining. In Costa Rica, after a long campaign of awareness and national mobilization, the legislature voted unanimously in 2010 to prohibit open-pit mining and ban the use of cyanide and mercury in mining activities.

Yet both countries are being punished for heeding their citizens’ demands. Several U.S. and Canadian companies have been using DR-CAFTA’s investor-state provisions to sue these governments directly. Such disputes are arbitrated by secret tribunals like the International Center for the Settlement of Investment Disputes, which is hosted by the World Bank and is not accountable to any democratic body.

In 2009, the U.S.-based Commerce Group sued El Salvador for closing a highly polluting mine. The case was dismissed in 2011for lack of jurisdiction, but El Salvador still had to pay several million dollars in fees for its defense. In a case still in process, the gold-mining conglomerate Pacific Rim has also sued El Salvadorunder DR-CAFTA for its anti-mining regulations. To get around the fact that the Canadian company wasn’t from a signatory country to DR-CAFTA, it moved its subsidiary from the Cayman Islands to Reno, Nevada in a bid to use the agreement’s provisions. Although that trick failed, the suit has moved forward under an outdated investment law of El Salvador.

Elsewhere, Infinito Gold has used DR-CAFTA to sue Costa Ricafor nearly $100 million over disputes related to gold mining. And the U.S.-based Corona Materials has filed a notice of intent to sue the Dominican Republic, also claiming violations of DR-CAFTA. These costly legal cases can have devastating effects on the national economies of these small countries.

Of course, investor-state disputes under DR-CAFTA are not only related to mining.

For example, TECO Guatemala Holdings, a U.S. corporation, alleged in 2009 that Guatemala had wrongfully interfered with its indirect subsidiary’s investment in an electricity distribution company. Specifically, TECO charged that the government had not protected its right to a “minimum standard of treatment”— an exceptionally vague standard that is open to wide interpretation by the international tribunals that rule on such cases — concerning the setting of rates by government regulators. In other words, TECO wanted to charge higher electricity rates to Guatemalan users than those the state deemed fair. Guatemala had to pay $21.1 million in compensatory damages and $7.5 million in legal fees, above and beyond what it spent on its own defense.

The U.S.-based Railroad Development Corporation also sued Guatemala, leading to the country paying out an additional $11.3 million, as well as covering both its own legal fees and the company’s. Elsewhere, Spence International Investments and other companies sued Costa Rica for its decision to expropriate land for a public ecological park.

In contrast to their Central American neighbors, El Salvador and Costa Rica have imposed regulations to defend their environments from destructive mining practices. Community pressure to protect the scarce watersheds of El Salvador—which are deeply vulnerable to toxic mining runoff—has so far prevented companies from successfully extracting minerals like gold on a large scale, and the Salvadoran government has put a moratorium on mining. In Costa Rica, after a long campaign of awareness and national mobilization, the legislature voted unanimously in 2010 to prohibit open-pit mining and ban the use of cyanide and mercury in mining activities.

Yet both countries are being punished for heeding their citizens’ demands. Several U.S. and Canadian companies have been using DR-CAFTA’s investor-state provisions to sue these governments directly. Such disputes are arbitrated by secret tribunals like the International Center for the Settlement of Investment Disputes, which is hosted by the World Bank and is not accountable to any democratic body.

In 2009, the U.S.-based Commerce Group sued El Salvador for closing a highly polluting mine. The case was dismissed in 2011for lack of jurisdiction, but El Salvador still had to pay several million dollars in fees for its defense. In a case still in process, the gold-mining conglomerate Pacific Rim has also sued El Salvadorunder DR-CAFTA for its anti-mining regulations. To get around the fact that the Canadian company wasn’t from a signatory country to DR-CAFTA, it moved its subsidiary from the Cayman Islands to Reno, Nevada in a bid to use the agreement’s provisions. Although that trick failed, the suit has moved forward under an outdated investment law of El Salvador.

Elsewhere, Infinito Gold has used DR-CAFTA to sue Costa Ricafor nearly $100 million over disputes related to gold mining. And the U.S.-based Corona Materials has filed a notice of intent to sue the Dominican Republic, also claiming violations of DR-CAFTA. These costly legal cases can have devastating effects on the national economies of these small countries.

Of course, investor-state disputes under DR-CAFTA are not only related to mining.

For example, TECO Guatemala Holdings, a U.S. corporation, alleged in 2009 that Guatemala had wrongfully interfered with its indirect subsidiary’s investment in an electricity distribution company. Specifically, TECO charged that the government had not protected its right to a “minimum standard of treatment”— an exceptionally vague standard that is open to wide interpretation by the international tribunals that rule on such cases — concerning the setting of rates by government regulators. In other words, TECO wanted to charge higher electricity rates to Guatemalan users than those the state deemed fair. Guatemala had to pay $21.1 million in compensatory damages and $7.5 million in legal fees, above and beyond what it spent on its own defense.

The U.S.-based Railroad Development Corporation also sued Guatemala, leading to the country paying out an additional $11.3 million, as well as covering both its own legal fees and the company’s. Elsewhere, Spence International Investments and other companies sued Costa Rica for its decision to expropriate land for a public ecological park.

So let’s look closely at the real impact trade agreements have on people and the environment.

A prime example is the Dominican Republic-Central America Free Trade Agreement, or DR-CAFTA. Brokered by the George W. Bush administration and a handful of hemispheric allies, the pact has had a devastating effect on poverty, dislocation, and environmental contamination in the region.

And perhaps even worse, it’s diminished the ability of Central American countries to protect their citizens from corporate abuse.

So let’s look closely at the real impact trade agreements have on people and the environment.

A prime example is the Dominican Republic-Central America Free Trade Agreement, or DR-CAFTA. Brokered by the George W. Bush administration and a handful of hemispheric allies, the pact has had a devastating effect on poverty, dislocation, and environmental contamination in the region.

And perhaps even worse, it’s diminished the ability of Central American countries to protect their citizens from corporate abuse.

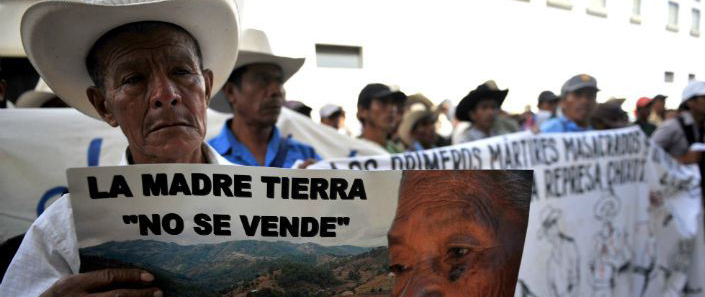

A Premonition

In 2004 and 2005, hundreds of thousands of protesters filled Central America’s streets. They warned of the unemployment, poverty, hunger, pollution, diminished national sovereignty, and other problems that could result if DR-CAFTA were approved. But despite popular pressure, the agreement was ratified in seven countries—including Guatemala, Nicaragua, El Salvador, Honduras, Costa Rica, the Dominican Republic, and the United States. Ten years after the approval of DR-CAFTA, we are seeing many of the effects they cautioned about. Overall economic indicators in the region have been poor, with some governments unable to provide basic services to the population. Farmers have been displaced when they can’t compete with grain importedfrom the United States. Amid significant levels of unemployment, labor abuses continue. Workers in export assembly plants often suffer poor working conditions and low wages. And natural resource extraction has proceeded with few protections for the environment. Contrary to the promises of U.S. officials—who claimed the agreement would improve Central American economies and thereby reduce undocumented immigration—large numbers of Central Americans have migrated to the United States, as dramatized most recently by the influx of children from Guatemala, El Salvador, and Honduras crossing the U.S.-Mexican border last summer. Although most are urgently fleeing violence in their countries, there are important economic roots to the migration—many of which are related to DR-CAFTA. One of the most pernicious features of the agreement is a provision called the Investor-State Dispute Settlement mechanism. This allows private corporations to sue governments over alleged violations of a long list of so-called “investor protections.” The most controversial cases have involved public interest laws and regulations that corporations claim reduce the value of their investments. That means corporations can sue those countries for profits they say they would have made had those regulations not been put into effect. Such lawsuits can be financially devastating to poor countries that already struggle to provide basic services to their people, much less engage in costly court battles with multinational firms. They can also prevent governments from making democratically accountable decisions in the first place, pushing them to prioritize the interests of transnational corporations over the needs of their citizens.The Mining Industry Strikes Gold

These perverse incentives have led to environmental deregulation and increased protections for companies, which have contributed to a boon in the toxic mining industry—with gold at the forefront. A stunning 14 percent of Central American territory is now authorized for mining. According to the Center of Research on Trade and Investment, a Salvadoran NGO, that number approaches 30 percent in Guatemala and Nicaragua—and rises to a whopping 35 percent in Honduras. In contrast to their Central American neighbors, El Salvador and Costa Rica have imposed regulations to defend their environments from destructive mining practices. Community pressure to protect the scarce watersheds of El Salvador—which are deeply vulnerable to toxic mining runoff—has so far prevented companies from successfully extracting minerals like gold on a large scale, and the Salvadoran government has put a moratorium on mining. In Costa Rica, after a long campaign of awareness and national mobilization, the legislature voted unanimously in 2010 to prohibit open-pit mining and ban the use of cyanide and mercury in mining activities.

Yet both countries are being punished for heeding their citizens’ demands. Several U.S. and Canadian companies have been using DR-CAFTA’s investor-state provisions to sue these governments directly. Such disputes are arbitrated by secret tribunals like the International Center for the Settlement of Investment Disputes, which is hosted by the World Bank and is not accountable to any democratic body.

In 2009, the U.S.-based Commerce Group sued El Salvador for closing a highly polluting mine. The case was dismissed in 2011for lack of jurisdiction, but El Salvador still had to pay several million dollars in fees for its defense. In a case still in process, the gold-mining conglomerate Pacific Rim has also sued El Salvadorunder DR-CAFTA for its anti-mining regulations. To get around the fact that the Canadian company wasn’t from a signatory country to DR-CAFTA, it moved its subsidiary from the Cayman Islands to Reno, Nevada in a bid to use the agreement’s provisions. Although that trick failed, the suit has moved forward under an outdated investment law of El Salvador.

Elsewhere, Infinito Gold has used DR-CAFTA to sue Costa Ricafor nearly $100 million over disputes related to gold mining. And the U.S.-based Corona Materials has filed a notice of intent to sue the Dominican Republic, also claiming violations of DR-CAFTA. These costly legal cases can have devastating effects on the national economies of these small countries.

Of course, investor-state disputes under DR-CAFTA are not only related to mining.

For example, TECO Guatemala Holdings, a U.S. corporation, alleged in 2009 that Guatemala had wrongfully interfered with its indirect subsidiary’s investment in an electricity distribution company. Specifically, TECO charged that the government had not protected its right to a “minimum standard of treatment”— an exceptionally vague standard that is open to wide interpretation by the international tribunals that rule on such cases — concerning the setting of rates by government regulators. In other words, TECO wanted to charge higher electricity rates to Guatemalan users than those the state deemed fair. Guatemala had to pay $21.1 million in compensatory damages and $7.5 million in legal fees, above and beyond what it spent on its own defense.

The U.S.-based Railroad Development Corporation also sued Guatemala, leading to the country paying out an additional $11.3 million, as well as covering both its own legal fees and the company’s. Elsewhere, Spence International Investments and other companies sued Costa Rica for its decision to expropriate land for a public ecological park.

In contrast to their Central American neighbors, El Salvador and Costa Rica have imposed regulations to defend their environments from destructive mining practices. Community pressure to protect the scarce watersheds of El Salvador—which are deeply vulnerable to toxic mining runoff—has so far prevented companies from successfully extracting minerals like gold on a large scale, and the Salvadoran government has put a moratorium on mining. In Costa Rica, after a long campaign of awareness and national mobilization, the legislature voted unanimously in 2010 to prohibit open-pit mining and ban the use of cyanide and mercury in mining activities.

Yet both countries are being punished for heeding their citizens’ demands. Several U.S. and Canadian companies have been using DR-CAFTA’s investor-state provisions to sue these governments directly. Such disputes are arbitrated by secret tribunals like the International Center for the Settlement of Investment Disputes, which is hosted by the World Bank and is not accountable to any democratic body.

In 2009, the U.S.-based Commerce Group sued El Salvador for closing a highly polluting mine. The case was dismissed in 2011for lack of jurisdiction, but El Salvador still had to pay several million dollars in fees for its defense. In a case still in process, the gold-mining conglomerate Pacific Rim has also sued El Salvadorunder DR-CAFTA for its anti-mining regulations. To get around the fact that the Canadian company wasn’t from a signatory country to DR-CAFTA, it moved its subsidiary from the Cayman Islands to Reno, Nevada in a bid to use the agreement’s provisions. Although that trick failed, the suit has moved forward under an outdated investment law of El Salvador.

Elsewhere, Infinito Gold has used DR-CAFTA to sue Costa Ricafor nearly $100 million over disputes related to gold mining. And the U.S.-based Corona Materials has filed a notice of intent to sue the Dominican Republic, also claiming violations of DR-CAFTA. These costly legal cases can have devastating effects on the national economies of these small countries.

Of course, investor-state disputes under DR-CAFTA are not only related to mining.

For example, TECO Guatemala Holdings, a U.S. corporation, alleged in 2009 that Guatemala had wrongfully interfered with its indirect subsidiary’s investment in an electricity distribution company. Specifically, TECO charged that the government had not protected its right to a “minimum standard of treatment”— an exceptionally vague standard that is open to wide interpretation by the international tribunals that rule on such cases — concerning the setting of rates by government regulators. In other words, TECO wanted to charge higher electricity rates to Guatemalan users than those the state deemed fair. Guatemala had to pay $21.1 million in compensatory damages and $7.5 million in legal fees, above and beyond what it spent on its own defense.

The U.S.-based Railroad Development Corporation also sued Guatemala, leading to the country paying out an additional $11.3 million, as well as covering both its own legal fees and the company’s. Elsewhere, Spence International Investments and other companies sued Costa Rica for its decision to expropriate land for a public ecological park.